An ACA category contains employee offer and coverage information which applies to a specific group of employees. A category is assigned to an employee when a designation ACA record is created for the employee. A designation ACA record holds the employee's status (full-time or variable hours) and the ACA category as of an effective date. In particular, a designation record is created for an employee when the employee is hired, changes status from full-time to part-time or vice versa, and when the employee separates from the company. The information from the ACA category is used in the Create IRS 1095-C Transmission process to provide 1095-C details for any employee whose offer code, employee required contribution, safe harbor code, and/or plan start month are blank.

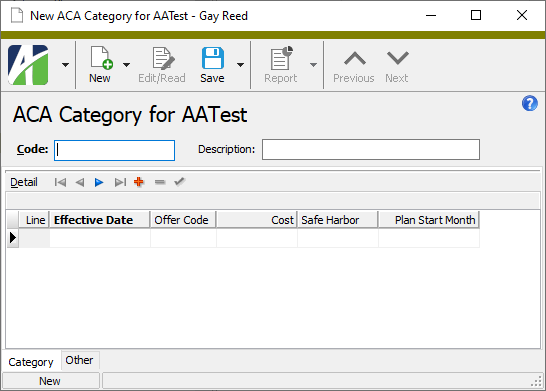

Create an ACA category

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > ACA > Categories folder.

-

Click

. The New ACA Category window opens.

. The New ACA Category window opens.

- Enter a unique Code for the ACA category.

- Enter a Description of the ACA category.

- In the Detail table, enter the following information for each change in category settings:

In the Effective Date column, enter the date the corresponding category settings take effect.

Note

Effective dates must fall on the first day of a month.

- In the Offer Code column, select the default offer code to apply to the employees the ACA category is assigned to. Valid offer codes are:

- <blank>. Do not apply a default offer code.

- 1A. A qualifying offer was made.

- 1B. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee only.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee only. - 1C. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s), excluding spouse.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s), excluding spouse. - 1D. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's spouse.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's spouse. - 1E. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and spouse.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and spouse. - 1F. Minimum essential coverage not providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee, to the employee and spouse or dependent(s), or to the employee, spouse, and dependents.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee, to the employee and spouse or dependent(s), or to the employee, spouse, and dependents. - 1G. Coverage was offered to a non-full-time employee who enrolled in self-insured coverage.

- 1H. Coverage was not offered, or coverage that did not provide minimum essential coverage was offered. This code includes individuals who are not employed for one or more months.

- 1I. Reserved.

- 1J. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered CONDITIONALLY to the employee's spouse.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered CONDITIONALLY to the employee's spouse. - 1K. Minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and offered CONDITIONALLY to the employee's spouse.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and offered CONDITIONALLY to the employee's spouse.

The following offer codes were added in tax year 2020.

- 1L. Individual coverage HRA

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary residence. - 1M. Individual coverage HRA

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary residence. - 1N. Individual coverage HRA

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary residence. - 1O. Individual coverage HRA

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary employment site. - 1P. Individual coverage HRA

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary employment site. - 1Q. Individual coverage HRA

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary employment site. - 1R. Individual coverage HRA

Health Reimbursement Arrangement that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse, and dependent(s).

Health Reimbursement Arrangement that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse, and dependent(s). - 1S. Individual coverage HRA

Health Reimbursement Arrangement offered to an individual who was not a full-time employee.

Health Reimbursement Arrangement offered to an individual who was not a full-time employee. - 1T - 1Z. Reserved for future use.

- In the Cost column, enter the employee's required contribution for self-only minimum essential coverage providing minimum value

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. that is offered to employees the ACA category is assigned to. This amount is used on the 1095-C only when the corresponding offer code is 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, or 1Q.

Minimum value refers to the percent of the cost of benefits a plan pays. A plan provides minimum value if it pays at least 60% of the costs of benefits for a standard population and provides substantial coverage of inpatient hospitalization services and physician services. that is offered to employees the ACA category is assigned to. This amount is used on the 1095-C only when the corresponding offer code is 1B, 1C, 1D, 1E, 1J, 1K, 1L, 1M, 1N, 1O, 1P, or 1Q. - In the Safe Harbor column, select the default safe harbor code to apply to the employees the ACA category is assigned to. Valid safe harbor codes are:

- <blank>. Do not apply a safe harbor code.

- 2A. Employee was not employed on any day during the month.

- 2B. Employee was not a full-time employee.

- 2C. Employee enrolled in the coverage offered.

- 2D. Employee was in a limited non-assessment period.

- 2E. The multiemployer interim relief rule was applied.

- 2F. Employer is claiming the Form W-2 safe harbor.

- 2G. Employer is claiming the federal poverty line safe harbor.

- 2H. Employer is claiming the rate of pay safe harbor.

- 2I. Reserved for future use.

- In the Plan Start Month column, enter the number of the month when the insurance plan year starts. A value is required for any ACA category that is effective as of the 2020 tax year or later.

- Save your changes.

Purpose

The ACA Categories Listing provides a list of the ACA categories defined in Payroll.

Content

For each ACA category included on the report, the listing shows:

- category code

- description.

For each detail record for each ACA category included on the report, the listing shows:

- effective date

- offer code

- safe harbor code

- plan start month

- employee required contribution.

In addition, you can include one or more of the following:

- timestamps

- memos

- custom fields.

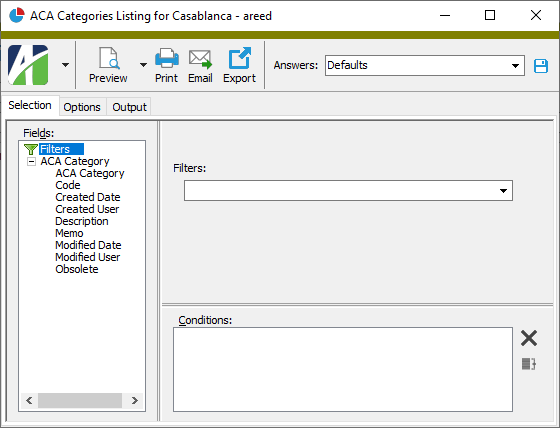

Print the report

- In the Navigation pane, highlight the Payroll/Human Resources > Setup > ACA > Categories folder.

- Start the report set-up wizard.

- To report on all or a filtered subset of ACA categories:

- Right-click the Categories folder and select Select and Report > ACA Categories Listing from the shortcut menu.

- On the Selection tab, define any filters to apply to the data.

- To report on specifically selected ACA categories:

- In the HD view, select the ACA categories to include on the report. You can use Ctrl and/or Shift selection to select multiple records.

- Click

and select ACA Categories Listing from the drop-down menu.

and select ACA Categories Listing from the drop-down menu.

- To report on a particular ACA category from the ACA Category window:

- In the HD view, locate and double-click the ACA category to report on. The ACA Category window opens with the ACA category loaded.

- Click

and select ACA Categories Listing from the drop-down menu.

and select ACA Categories Listing from the drop-down menu.

- To report on all or a filtered subset of ACA categories:

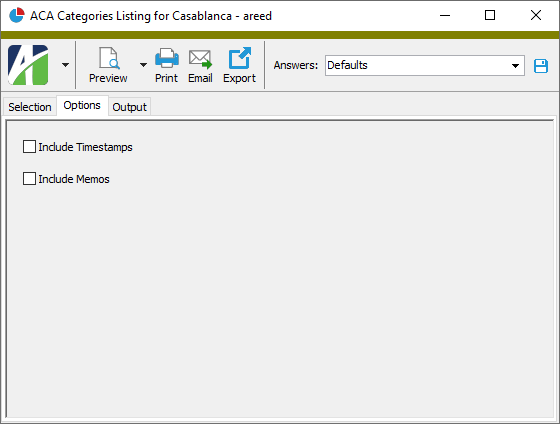

- Select the Options tab.

- Mark the checkbox(es) for the additional information to include:

- Timestamps

- Memos

- Custom Fields (only visible if custom fields are set up)

- Select the Output tab.

- In the Design field, look up and select the report design to use.

- In the toolbar, click the icon for the type of output you want:

- Provides access to two preview options.

- Provides access to two preview options.- Preview - Click the icon or click the drop-down arrow and select Preview from the drop-down menu to view the report in the Crystal Reports viewer.

- Preview to PDF - Click the drop-down arrow next to the icon and select Preview to PDF to view the report in the PDF reader.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report.

- Opens the Print dialog so that you can select and configure a printer and then print a paper copy of the report. - Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email.

- Opens the Report Email dialog so that you can address and compose an email that the report will be attached to. For best results, ensure your email client is running before you attempt to send a report via email. - Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

- Opens the Export Report dialog so that you can save the report to a file. File types include Crystal Reports (.rpt), PDF (.pdf), Microsoft Excel (.xls), Microsoft Word (.doc), rich text (.rtf), and XML (.xml).

Data extensions

The following data extensions are available for the report:

- ACA categories

- ACA category detail

ACA Category Record ID

Category tab

The date the corresponding category settings take effect.

Note

Effective dates must fall on the first day of a month.

The default offer code to apply to the employees the ACA category is assigned to. Valid offer codes are:

- <blank>. Do not apply a default offer code.

- 1A. A qualifying offer was made.

- 1B. Minimum essential coverage providing minimum value was offered to the employee only.

- 1C. Minimum essential coverage providing minimum value was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s), excluding spouse.

- 1D. Minimum essential coverage providing minimum value was offered to the employee and at least minimum essential coverage was offered to the employee's spouse.

- 1E. Minimum essential coverage providing minimum value was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and spouse.

- 1F. Minimum essential coverage not providing minimum value was offered to the employee, to the employee and spouse or dependent(s), or to the employee, spouse, and dependents.

- 1G. Coverage was offered to a non-full-time employee who enrolled in self-insured coverage.

- 1H. Coverage was not offered, or coverage that did not provide minimum essential coverage was offered. This code includes individuals who are not employed for one or more months.

- 1I. Reserved.

- 1J. Minimum essential coverage providing minimum value was offered to the employee and at least minimum essential coverage was offered CONDITIONALLY to the employee's spouse.

- 1K. Minimum essential coverage providing minimum value was offered to the employee and at least minimum essential coverage was offered to the employee's dependent(s) and offered CONDITIONALLY to the employee's spouse.

The following offer codes were added in tax year 2020.

- 1L. Individual coverage HRA

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary residence. - 1M. Individual coverage HRA

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary residence. - 1N. Individual coverage HRA

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary residence.

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary residence. - 1O. Individual coverage HRA

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee only with affordability determined by using the ZIP code of the employee's primary employment site. - 1P. Individual coverage HRA

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee and dependent(s) (not spouse) with affordability determined by using the ZIP code of the employee's primary employment site. - 1Q. Individual coverage HRA

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary employment site.

Health Reimbursement Arrangement offered to employee, spouse, and dependent(s) with affordability determined by using the ZIP code of the employee's primary employment site. - 1R. Individual coverage HRA

Health Reimbursement Arrangement that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse, and dependent(s).

Health Reimbursement Arrangement that is NOT affordable offered to employee; employee and spouse, or dependent(s); or employee, spouse, and dependent(s). - 1S. Individual coverage HRA

Health Reimbursement Arrangement offered to an individual who was not a full-time employee.

Health Reimbursement Arrangement offered to an individual who was not a full-time employee. - 1T - 1Z. Reserved for future use.

The default safe harbor code to apply to the employees the ACA category is assigned to. Valid safe harbor codes are:

- <blank>. Do not apply a safe harbor code.

- 2A. Employee was not employed on any day during the month.

- 2B. Employee was not a full-time employee.

- 2C. Employee enrolled in the coverage offered.

- 2D. Employee was in a limited non-assessment period.

- 2E. The multiemployer interim relief rule was applied.

- 2F. Employer is claiming the Form W-2 safe harbor.

- 2G. Employer is claiming the federal poverty line safe harbor.

- 2H. Employer is claiming the rate of pay safe harbor.

- 2I. Reserved for future use.

Custom tab

This tab is visible if custom fields exist for the entity. At a minimum, if there are custom fields a Fields subtab will be present. One or more additional categories of subtabs may also be visible.

Fields subtab

This tab prompts for values for any custom fields set up for entity records of this entity type. Respond to the prompts as appropriate.

References subtab

This field is visible if other records reference the current record.

Example

Suppose a custom field exists on PRCodes that references an ARCode. On the ARCode record, on the Custom > References subtab, you can view all the PRCodes which reference that ARCode.

Exchange Folder subtab

This tab is visible only if you set up a custom field with a data type of "Exchange Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified exchange folder.

File subtab

This tab is visible only if you set up a custom field with a data type of "File". The label on the tab is the name assigned to the custom field.

This tab renders the contents of the specified file according to its file type.

Internet Address subtab

This tab is visible only if you set up a custom field with a data type of "Internet Address". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified web page.

Network Folder subtab

This tab is visible only if you set up a custom field with a data type of "Network Folder". The label on this tab is the name assigned to the custom field.

This tab shows the contents of the specified network folder.

Attachments tab

The Attachments tab is visible if any record for a given entity has an attachment. If the Attachments tab is not visible, this implies that no record of the entity type has an attachment on it; however, once an attachment is added to any record of the entity type, the Attachments tab will become available.

Other tab

Minimum essential coverage

Minimum essential coverage refers to what is included in healthcare coverage. Most employer-sponsored health plans can be assumed to provide minimum essential coverage.

Minimum essential coverage includes:

- Coverage under health plans offered in the individual market.

- Most coverage through government-sponsored programs.

- Most types of employee-sponsored coverage.

- Grandfathered health plans.

- Other health coverage designated by the Department of Health and Human Services as minimum essential coverage.

ACA categories security

Common accesses available on ACA categories

Report Email dialog

- Windows user default account. Sends email using the user's Windows default email account. For most users, this is the account configured in Outlook or another email client application.

- Server personal. Sends email using the email configuration for the system or company server and the email address on the current user's authorized user record. The authorized user record must have a confirmed email address.

- Server generic. Sends email using the email configuration and "from" address for the system or company server. This option requires "Send generic" access to the Server Email resource.

|

5225 S Loop 289, #207 Lubbock, TX 79424 806.687.8500 | 800.354.7152 |

© 2025 AccountingWare, LLC All rights reserved. |